Value Added Tax

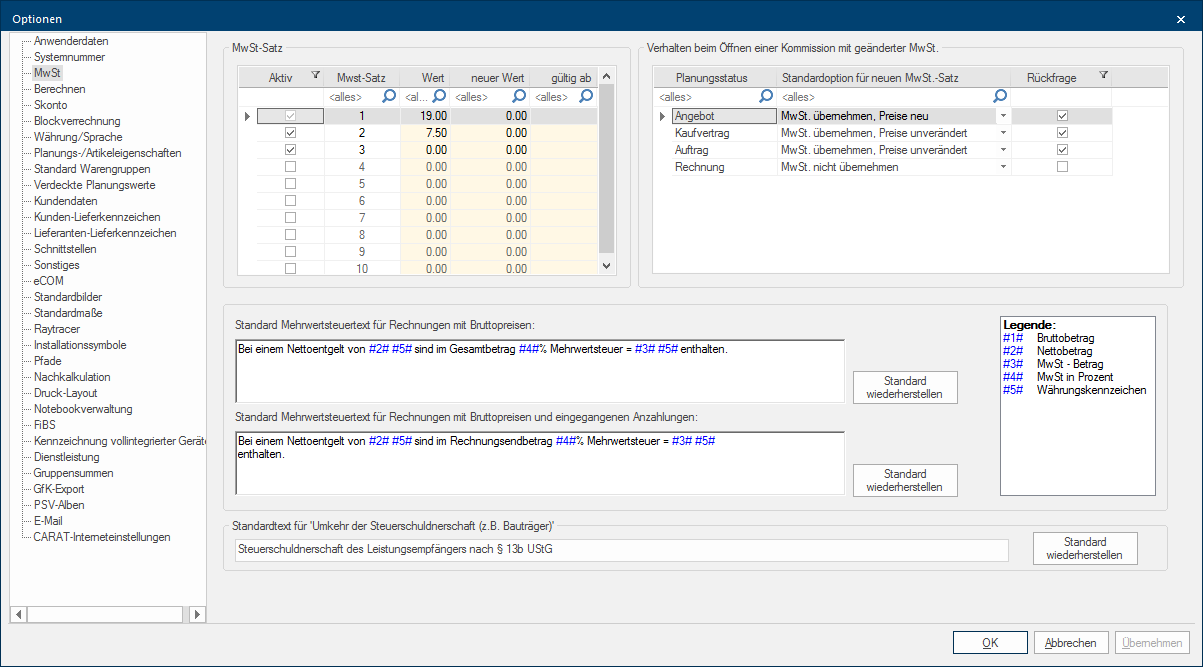

You can make all settings that are related to the calculation of and showing of the VAT on the page VAT. On one hand you can store the VAT rates here, as well as the necessary text modules to display the Value Added Addition (in Latin: addere) is one of four basic operations in arithmetic. In primary school and in common language it is the expression used for the adding of two or more numbers. Tax for deposits and invoices. You also have the possibility in this dialogue Dialogue, dialogue windows or dialogue fields are special windows in software applications. Dialogue windows are displayed by application programs in different situations to request input or confirmation from the user., to assign how CARAT should react to a changed value added tax, for a specific plan status.

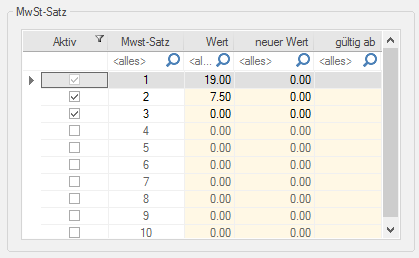

In CARAT you have the possibility to input up to 10 different VAT rates, so you can use articles with different tax rates in one order. VAT rate 1 should however, always be set to the normal standard VAT rate.

- To input another tax rate, please click Typically the LEFT mouse button is pressed once quickly, if not specified differently. Clicking will either mark an object, or when clicking on a button, the execution of the desired activity (e.g. OK, Cancel, Close). in the checkbox A checkbox is a standard element in a graphic user interface. A checkbox has, in most cases, two states (set or not set). These usually correspond to a yes/no selection. to activate the desired VAT rate. Then click in the respective field of the Value column and enter the VAT rate in percent. Confirm the input of the new entry with the enter key The enter key (also known as return or enter) is located on the right side of the letter part of your keyboard and is usually labelled with an arrow pointing to the left. This key causes a line break when used in word processing and is also used in software programs to confirm the currently marked button (usually OK or Cancel)..

- To modify an existing VAT rate, click on the corresponding entry in the Value column and directly input the new value. Confirm the modified input with the enter key.

- If a VAT rate is temporarily not needed, you can deactivate the relevant VAT rate by removing the check in the associated checkbox with a click of the left mouse button In dialogue windows you always find one or more buttons that can be activated by clicking on them. Typical functions for buttons are e.g. OK, Cancel, Apply. Buttons are always activated by a single click with the left mouse button.. If you would also like to delete the VAT rate that is no longer needed, click in the respective field in the Value column and then press the Delete key on your keyboard, to remove the value.

It can occur that, based on changes in the law, you are affected by a VAT-change. In this case you also have to modify the VAT in CARAT on a reference date. For that you have in CARAT, in the table with the VAT rates, the additional Addition (in Latin: addere) is one of four basic operations in arithmetic. In primary school and in common language it is the expression used for the adding of two or more numbers. columns New value as well as Valid from.

- To enter a new VAT rate, please click in the relevant field in the line of the required VAT rate and enter the value. Confirm the input of the new entry with the enter key. Please note that you close the page VAT with a click on the button OK, so that the settings are saved definitely.

To avoid that a quotation, with a fixed promised selling price, which you created in the transitional period before the reference date, will lower your gross profit based on higher VAT taxes, you should already allow for these higher taxes in your quotation via your surcharge factor.

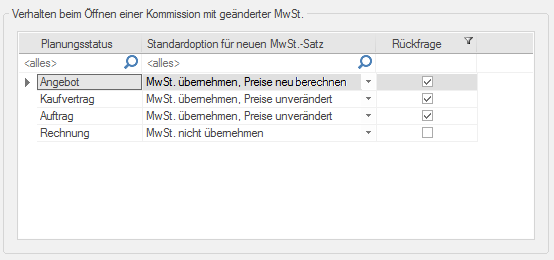

When opening a commission, CARAT checks whether a different VAT rate is being used from the current stored VAT rate. If this is the case, the action you have defined will be carried out. You can make the necessary settings for this in the area Conduct when opening.... Depending on the status of the plan you can specify which action should be taken and also if an appropriate enquiry should appear.

|

Name: |

Description: |

|---|---|

|

Take over VAT, prices new |

Using this option The word option (from Latin: optio = free will) used in computing means a choice. In CARAT it is normally used with a list box., the current VAT rate stored in the system options will be used and the prices will be newly calculated accordingly. This option is normally recommended for plans that are in the quotation status. |

|

Take over VAT, prices unchanged |

Using this option, the current VAT rate stored in the system will also be used, however the prices will not be recalculated. This option makes sense when the modified VAT rate has already been considered using a factor and the takeover of the modified VAT rate is only still needed for the correct display in the respective documentation. |

|

Do not take over VAT |

Using this option, the existing plan will not be changed. The VAT rates existing at the time of creation and also the according prices will be retained. This option should only be used when the plan has already been closed. This would be the case, for example, if the plan has already reached the invoice status. |

|

Enquiry: |

If you also activate the checkbox in the column Enquiry, the stored presetting will not immediately be taken over when opening a plan, but rather a dialogue will be displayed with which you have the option to also select another of the already preset options. |

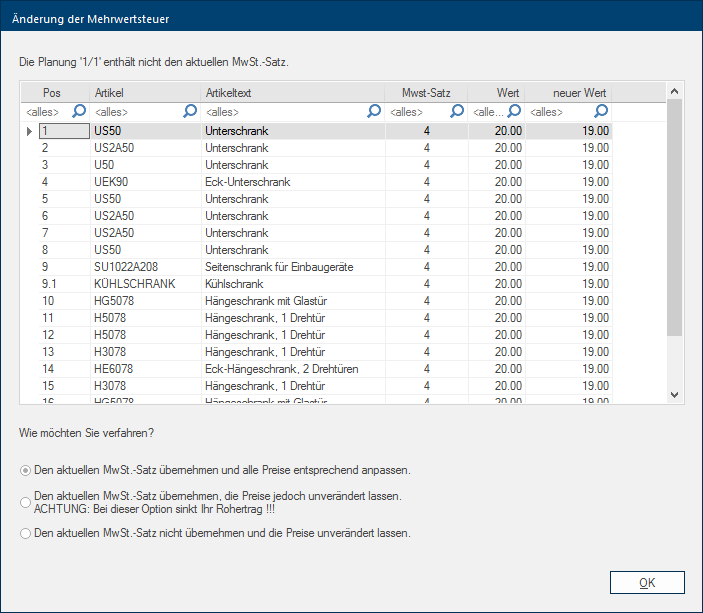

If you have marked the Enquiry checkbox in the area Conduct when opening..., the following dialogue will be displayed when opening a plan with a deviating VAT rate.

All articles that have been determined to have a differing tax rate, are for checking purposes listed in the dialogue. For a better overview, the tax rate existing in the plan as well as the new altered tax rate, are displayed. The actions you can take to adjust the plan for the new tax rate are displayed in the bottom area. There, the option that you have preset in the system options, for the respective plan status, is already selected. With a click on the OK button the selected option will be taken over in the plan and the appropriate action will be executed.

In CARAT you have the possibility to change the by CARAT already supplied standard text, with which you can show the necessary information for the tax authorities, according your needs.

As is already evident in the standard texts, you can insert a value by entering the respective Variable In CARAT, variables are wild cards that are used for different values and percent values, since the actual value changes, depending on the respective commission. By employing a variable in a document, for example a text for the VAT, can the VAT amount be supplemented with a wild card. When printing the document, the respective VAT amount will then be displayed in the location of the wild card. e.g. #2# (for the net total value) in the location in the text where later the actual value should appear. In the legend are the variables In CARAT, variables are wild cards that are used for different values and percent values, since the actual value changes, depending on the respective commission. By employing a variable in a document, for example a text for the VAT, can the VAT amount be supplemented with a wild card. When printing the document, the respective VAT amount will then be displayed in the location of the wild card., that stand for the respective values in the text, displayed. At your disposal are:

- #1# = Gross value

- #2# = Net total value

- #3# = VAT - Amount

- #4# = VAT in Percent

- #5# = Currency code

For builders and building contracts there is an exemption in German tax law that obligates first the invoice recipient to pay taxes. The fiscal technical term for it reads: Reversal of tax liability. For this special case, a separate standard text is provided for in CARAT.

The reversal of tax liability will always be activated for a customer address. To be able to use this option, a VAT rate of 0% must be recorded and activated. The relevant procedure was already described above.