Converting RRP into net-PP

How to determine the percentage amount of the value added Addition (in Latin: addere) is one of four basic operations in arithmetic. In primary school and in common language it is the expression used for the adding of two or more numbers. tax deduction has been described previously. Additionally Addition (in Latin: addere) is one of four basic operations in arithmetic. In primary school and in common language it is the expression used for the adding of two or more numbers. to the value added tax deduction you can, of course, also enter a condition of course, in order to have CARAT calculate the net-PP The PP (purchase price) in CARAT, refers to the price less conditions but before designated cash discounts and bonus. (excluding VAT) from your gross-PP Gross-PP in CARAT is the purchase price before the deduction of the conditions. (including VAT). Use the Conditions calculator to enter the condition values conveniently.

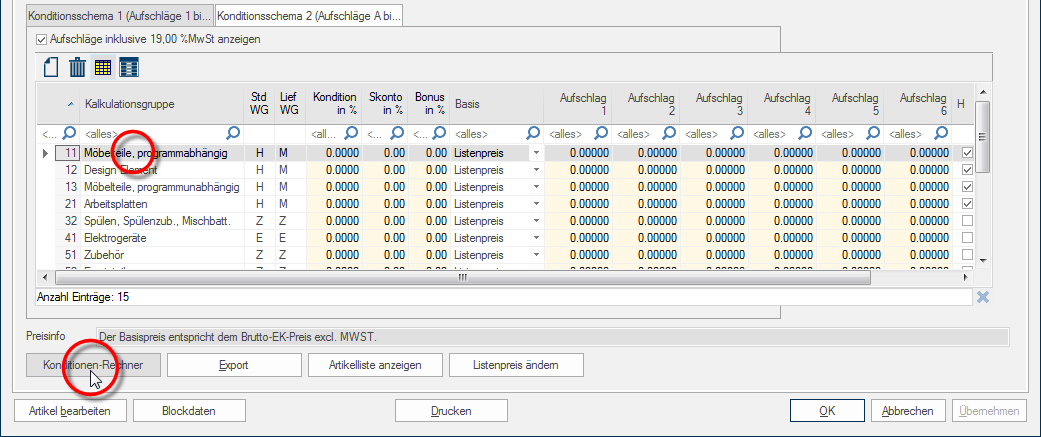

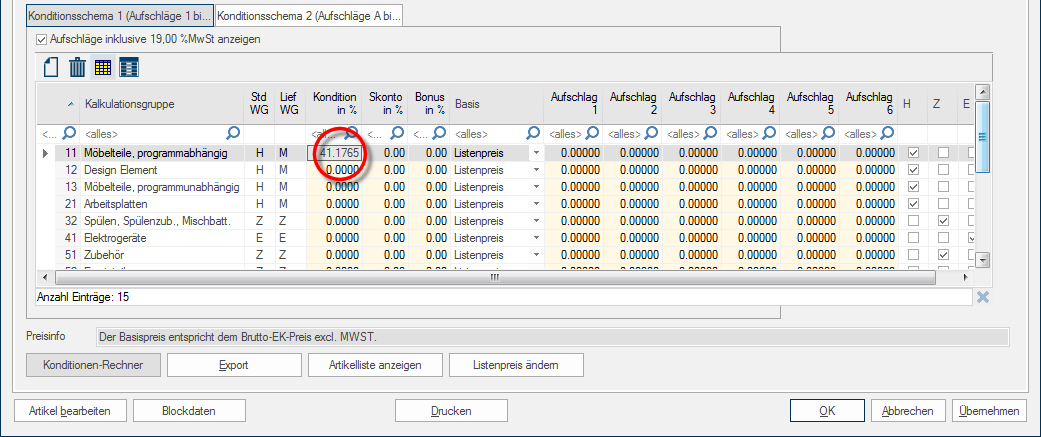

- To open the condition calculator, please first mark the calculation group In a calculation group are arranged any quantity of items that have an item specific similarity. So typically all items, e.g. furniture parts, but also worktops, sinks, or electrical appliances, are consolidated into appropriate named calculation groups. you want to edit, and click Typically the LEFT mouse button is pressed once quickly, if not specified differently. Clicking will either mark an object, or when clicking on a button, the execution of the desired activity (e.g. OK, Cancel, Close). subsequently on the Conditions calculator button In dialogue windows you always find one or more buttons that can be activated by clicking on them. Typical functions for buttons are e.g. OK, Cancel, Apply. Buttons are always activated by a single click with the left mouse button..

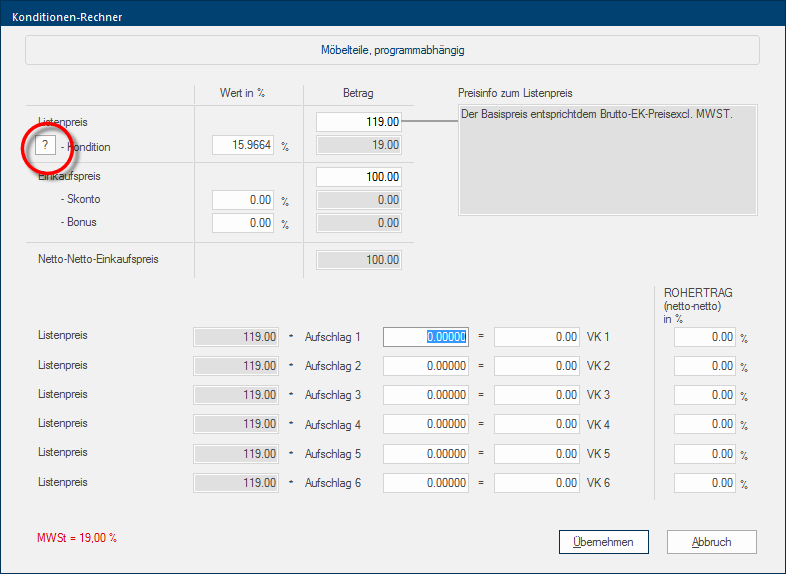

- Now click in the condition calculator on the small button with the question mark, in order to be able to enter several single conditions.

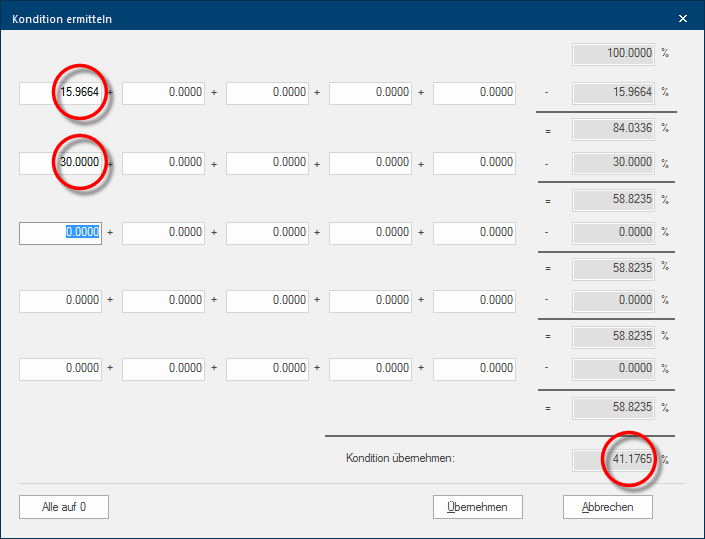

- In the dialogue Dialogue, dialogue windows or dialogue fields are special windows in software applications. Dialogue windows are displayed by application programs in different situations to request input or confirmation from the user. Determine condition you enter first the value of the VAT-deduction, which you have calculated before, in the first field of the upper row. This was in our example 15,9664%.

- Since the actual condition after conversion must be from the gross PP to the net PP, enter the condition (30%) in the first field of the second row. You can follow the calculation at right right side of the dialogue.

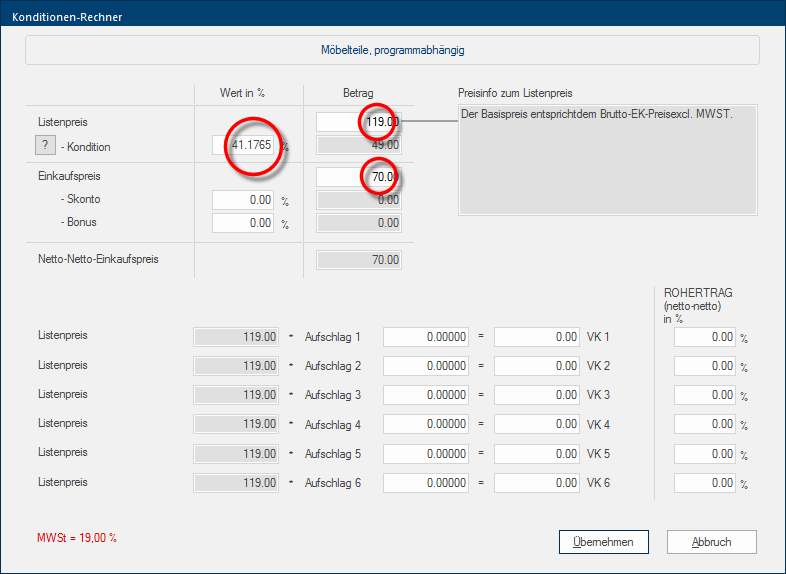

- The total condition will be taken over as soon as you click on the Apply button, and now can the PP based on the entered list price The list price in CARAT designates the price that was deposited by the manufacturer in the CARAT catalogue data. (RRP) be calculated in the conditions calculator.

- You can now apply the condition for the selected calculation group by clicking on the Apply button, thereby closing the conditions calculator at the same time.