The e-invoice

Starting from version V2025.1.0.1 you can create E-invoices in CARAT. The E-invoice enables the straightforward transmission of Electronic invoice data.

The E-invoices created in CARAT comply with National German requirements and the Requirements of the European Union by using the ZUGFeRD ZUGFeRD (acronym for Zentraler User Guide des Forums elektronische Rechnung Deutschland) is a specification for the new format of the same name for electronic invoices. A ZUGFeRD invoice includes the visual representation of the invoice for humans in PDF format and machine-readable structured data in XML format. Source: Wikipedia format The format or formatting (Latin, forma) is designated in word processing as the design of the text document. In this case meaning the selection of character fonts and character style such as bold or italics.. As of 2025, E-invoices are mandatory in Germany and most European countries only for Business transactions. If you want to learn more about further legal details and transition periods, or the future planned national regulations regarding e-invoices, please contact your tax advisor or the relevant tax office.

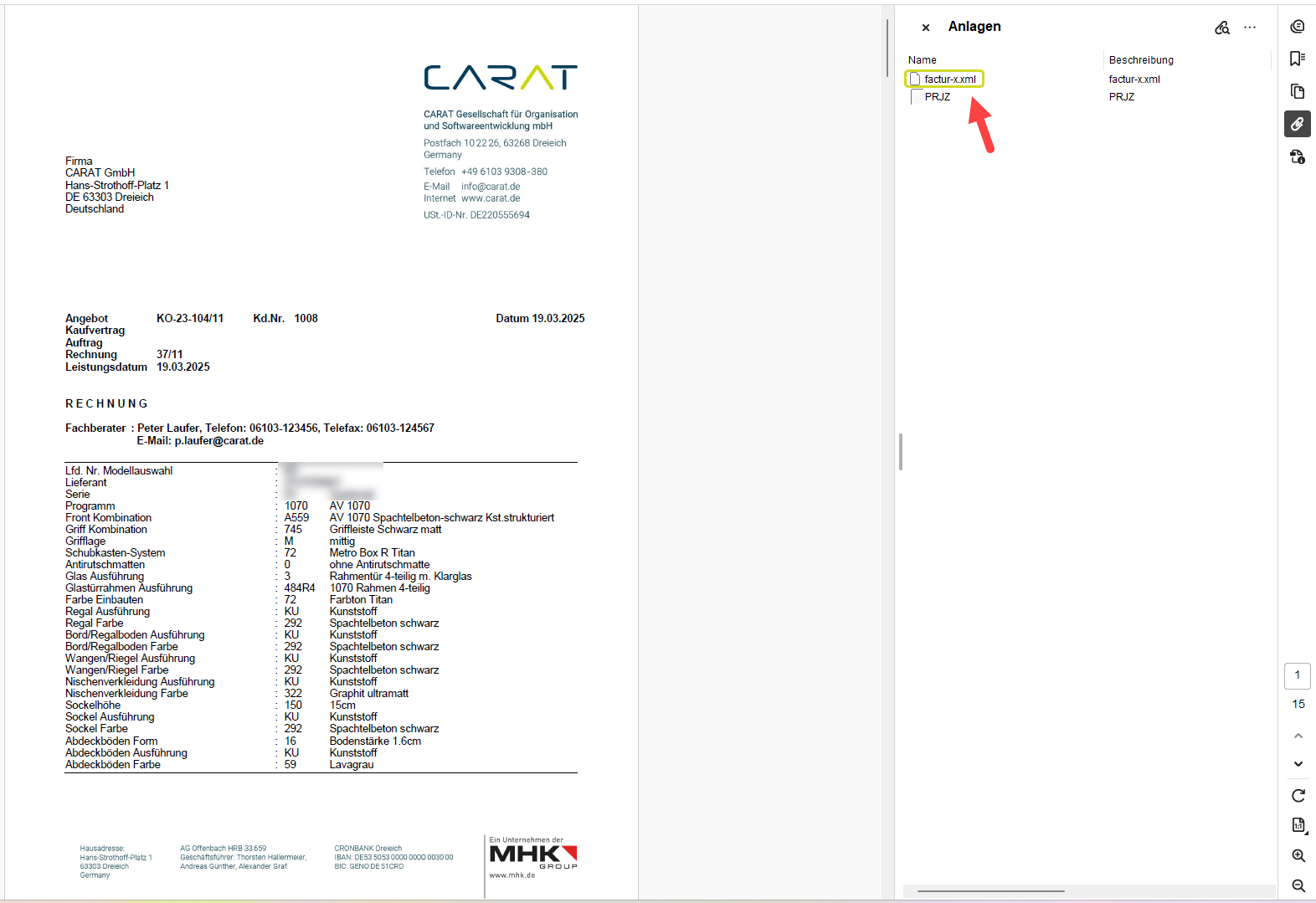

The E-invoice generated in CARAT consists of 2 parts. One PDF The Adobe Portable Document Format (PDF) was developed and perfected in the 80's by Adobe Systems. Adobe PDF files contain data from any application, that can be displayed on every computer, and are suitable thereby to be exchanged with users throughout the world.-document that the recipient can read and print, and an Attachment that contains the Electronic invoice data, identifiable by the designation Invoice-x.xml.

Example:

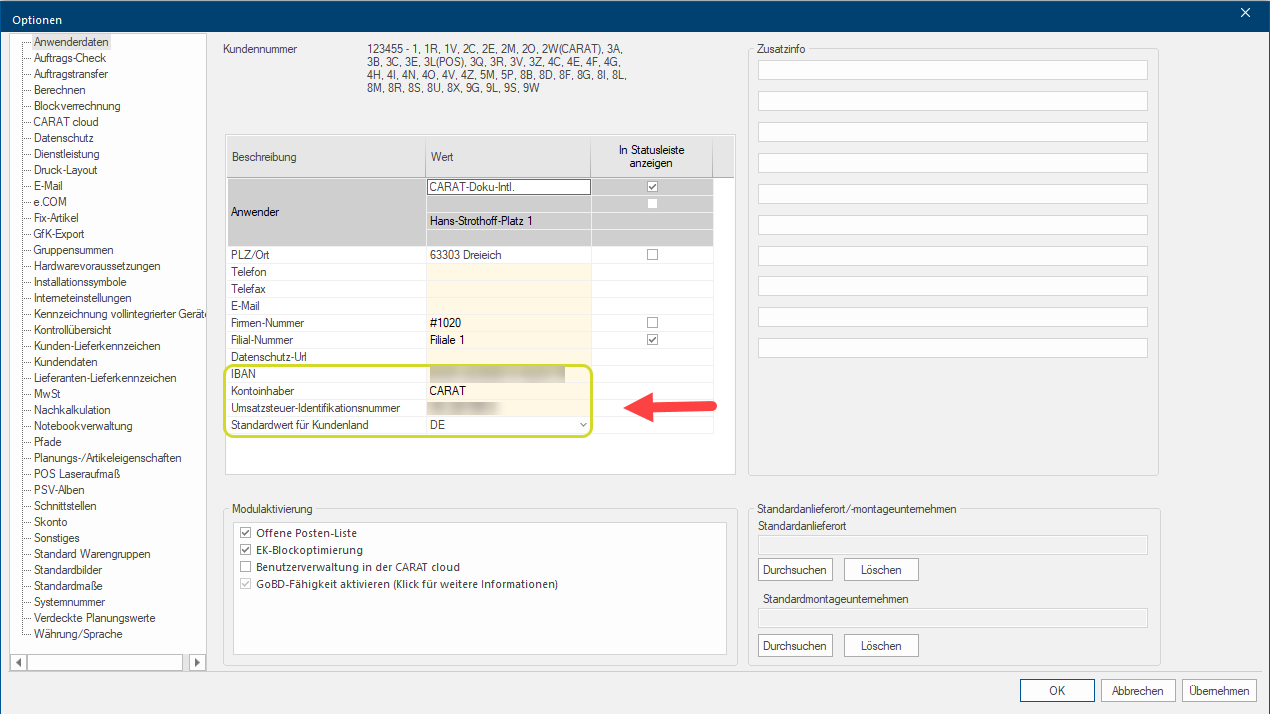

See also: User data

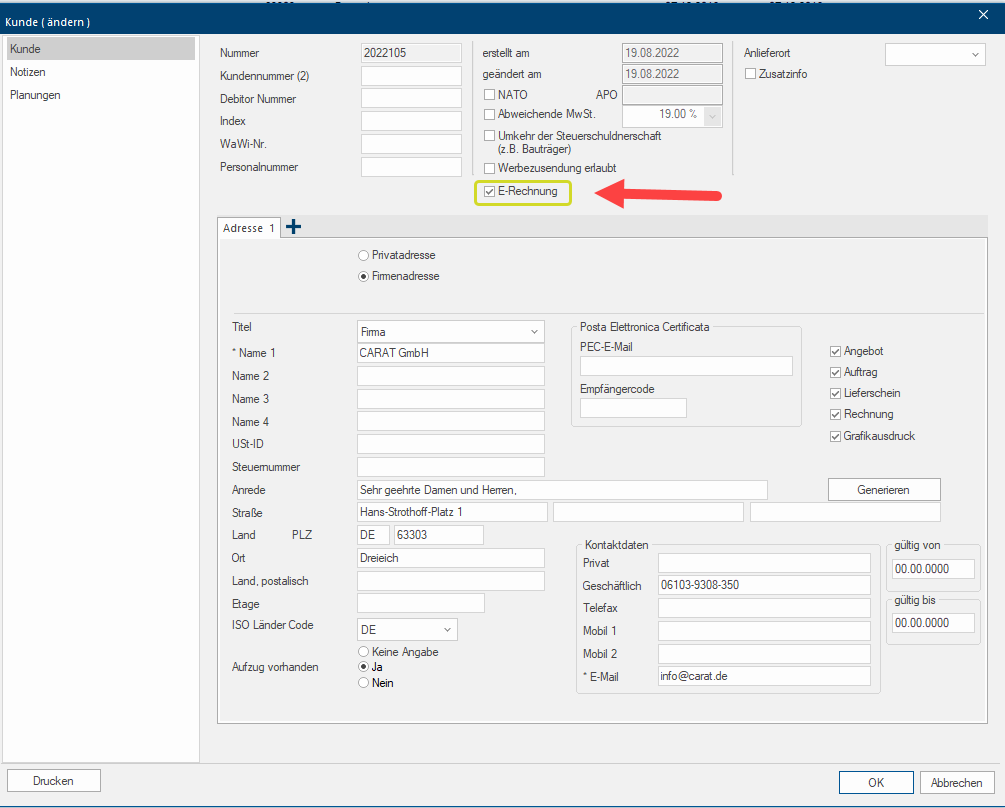

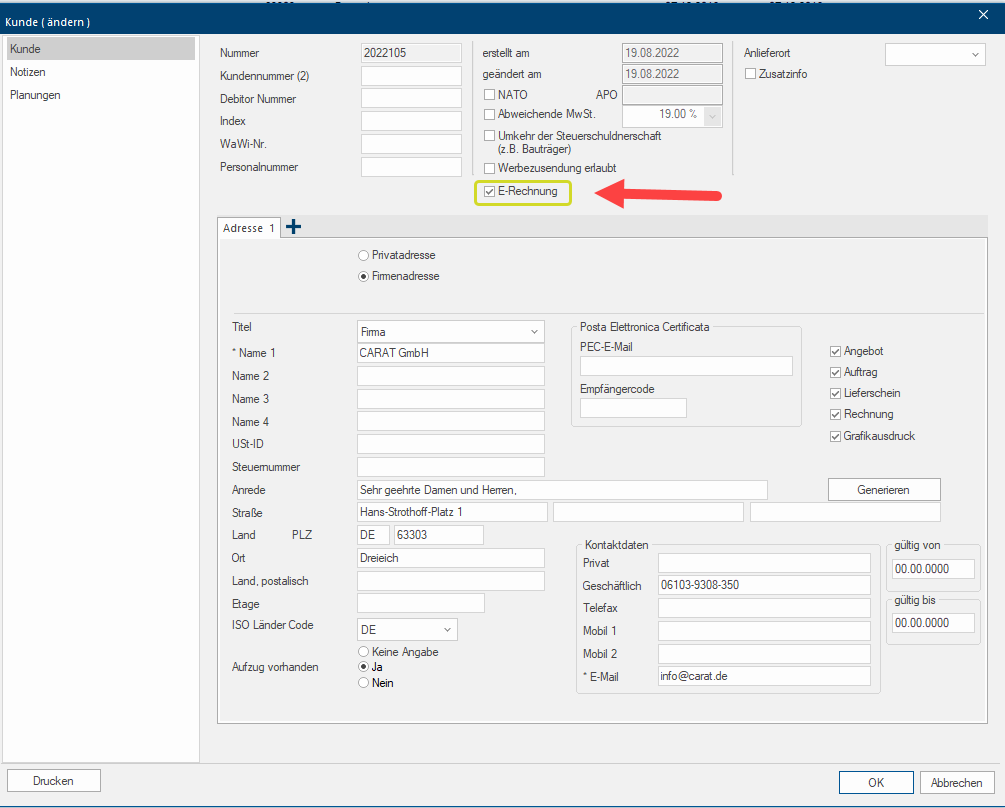

The E-invoice can be activated in the customer data. This is possible for both New and Existing customer data. To do this, tick the Checkbox A checkbox is a standard element in a graphic user interface. A checkbox has, in most cases, two states (set or not set). These usually correspond to a yes/no selection. in front of E-invoice in the Customer data.

See also: Customer data

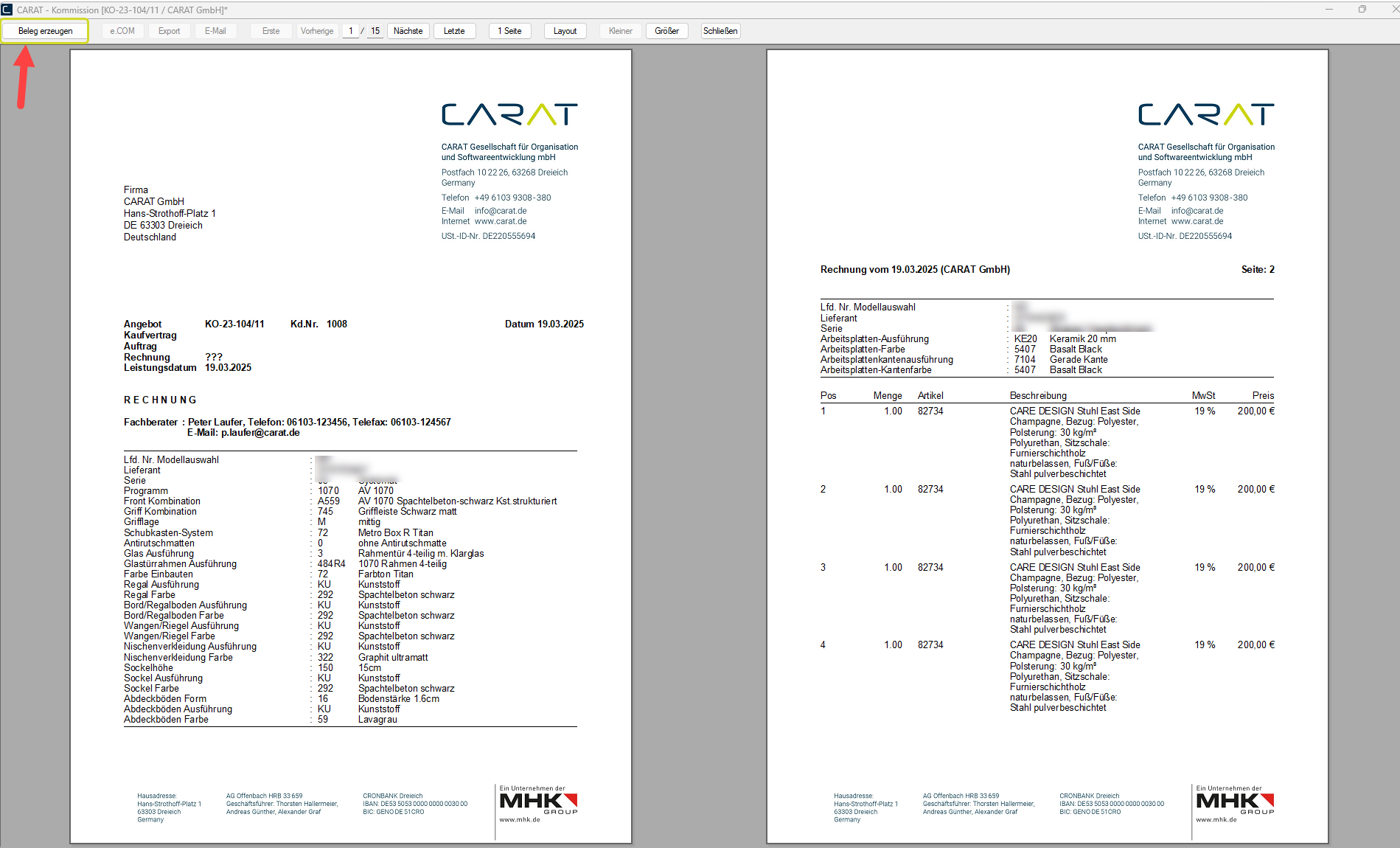

You generate the E-invoice in the same way as your previous invoices. As usual, once you have opened the Print preview for invoices, click Typically the LEFT mouse button is pressed once quickly, if not specified differently. Clicking will either mark an object, or when clicking on a button, the execution of the desired activity (e.g. OK, Cancel, Close). on Generate receipt.

See also: The Print Preview

Your E-invoice will then open as PDF-document with the Electronic invoice data in the Attachment. You can send this PDF-document.

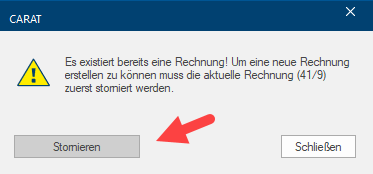

If you have activated the GoBD capability in the system options under user data, it is necessary to Cancel an existing Old invoice Before creating an E-invoice. This is also signalled to you by a corresponding message when you click on Generate receipt, from which you can cancel the Old invoice directly by clicking on Cancel.

If you have not activated the GoBD capability you can generate an E-invoice directly New by clicking on Generate receipt in the Print preview.

See also: GoBD - Principles of proper accounting